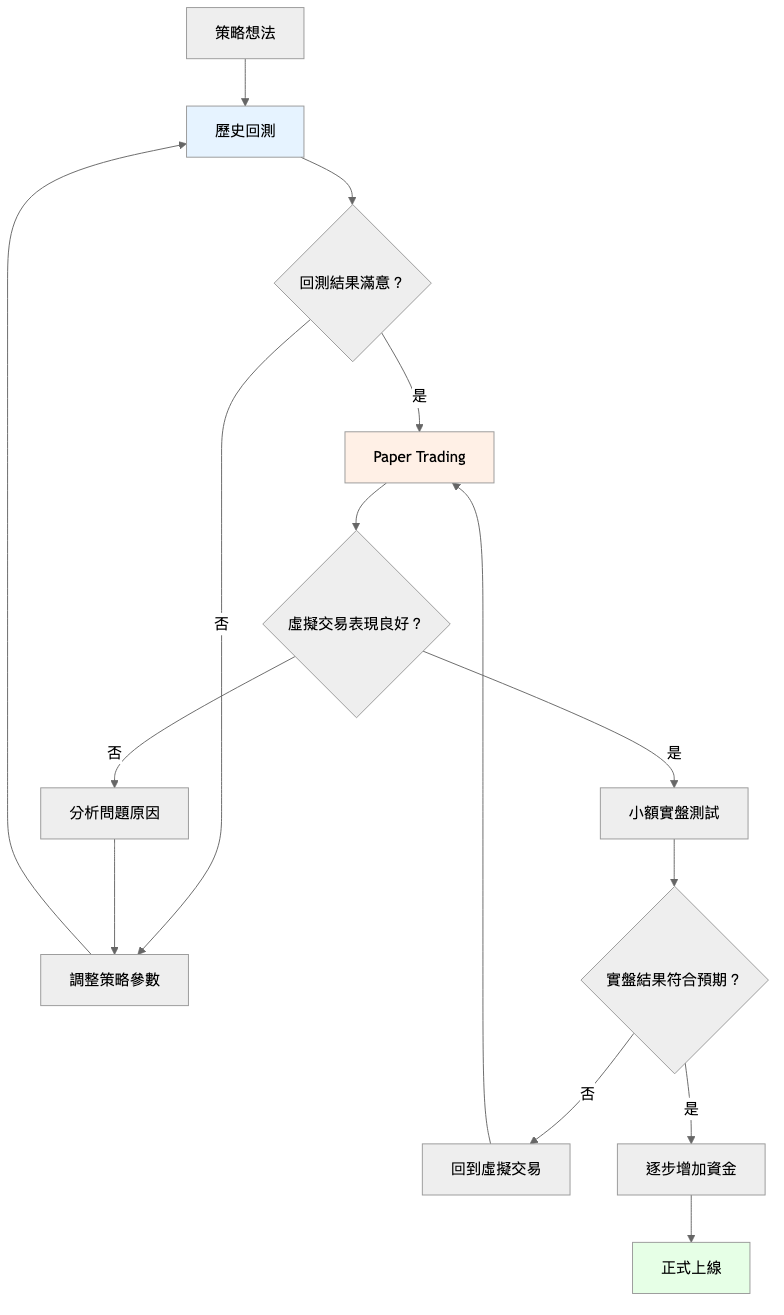

今天要學習量化交易的三個重要階段:回測、虛擬單、上線。這就像爸爸種新品種作物的流程一樣:先看歷史資料研究(回測),然後在小塊地試種(虛擬單),最後才大規模種植(上線)。這個循序漸進的過程確保我們不會因為貿然行動而遭受重大損失!

回測就像查看農場的歷史收成記錄:

import pandas as pd

import numpy as np

from datetime import datetime, timedelta

import matplotlib.pyplot as plt

class BacktestFramework:

"""回測框架"""

def __init__(self, initial_capital=100000):

self.initial_capital = initial_capital

self.current_capital = initial_capital

self.positions = {}

self.trades = []

self.equity_curve = []

def load_historical_data(self, symbol, start_date, end_date):

"""載入歷史數據"""

# 生成模擬歷史數據

dates = pd.date_range(start_date, end_date, freq='1D')

np.random.seed(42)

# 模擬價格走勢

returns = np.random.normal(0.001, 0.02, len(dates))

prices = [50000] # 起始價格

for ret in returns[1:]:

prices.append(prices[-1] * (1 + ret))

data = pd.DataFrame({

'timestamp': dates,

'open': prices,

'high': [p * (1 + abs(np.random.normal(0, 0.005))) for p in prices],

'low': [p * (1 - abs(np.random.normal(0, 0.005))) for p in prices],

'close': prices,

'volume': np.random.uniform(1000, 5000, len(dates))

})

return data.set_index('timestamp')

def calculate_indicators(self, data):

"""計算技術指標"""

# 移動平均線

data['sma_20'] = data['close'].rolling(20).mean()

data['sma_50'] = data['close'].rolling(50).mean()

# RSI

delta = data['close'].diff()

gain = (delta.where(delta > 0, 0)).rolling(14).mean()

loss = (-delta.where(delta < 0, 0)).rolling(14).mean()

rs = gain / loss

data['rsi'] = 100 - (100 / (1 + rs))

# 布林帶

data['bb_middle'] = data['close'].rolling(20).mean()

bb_std = data['close'].rolling(20).std()

data['bb_upper'] = data['bb_middle'] + (bb_std * 2)

data['bb_lower'] = data['bb_middle'] - (bb_std * 2)

return data

def generate_signals(self, data, strategy_name='ma_crossover'):

"""生成交易信號"""

if strategy_name == 'ma_crossover':

# 移動平均交叉策略

data['signal'] = 0

data['signal'] = np.where(

data['sma_20'] > data['sma_50'], 1, 0

)

data['position'] = data['signal'].diff()

elif strategy_name == 'rsi_reversal':

# RSI反轉策略

data['signal'] = 0

data['signal'] = np.where(data['rsi'] < 30, 1,

np.where(data['rsi'] > 70, -1, 0))

data['position'] = data['signal'].diff()

return data

def execute_backtest(self, data, commission=0.001):

"""執行回測"""

for timestamp, row in data.iterrows():

if pd.isna(row['position']) or row['position'] == 0:

continue

# 執行交易

if row['position'] == 1: # 買入信號

self._execute_buy(timestamp, row['close'], commission)

elif row['position'] == -1: # 賣出信號

self._execute_sell(timestamp, row['close'], commission)

# 記錄權益曲線

portfolio_value = self._calculate_portfolio_value(row['close'])

self.equity_curve.append({

'timestamp': timestamp,

'portfolio_value': portfolio_value,

'price': row['close']

})

def _execute_buy(self, timestamp, price, commission):

"""執行買入"""

if 'BTC' not in self.positions:

# 使用80%資金買入

trade_amount = self.current_capital * 0.8

quantity = trade_amount / price

cost = quantity * price * (1 + commission)

if cost <= self.current_capital:

self.positions['BTC'] = quantity

self.current_capital -= cost

self.trades.append({

'timestamp': timestamp,

'type': 'buy',

'quantity': quantity,

'price': price,

'cost': cost,

'commission': cost * commission

})

def _execute_sell(self, timestamp, price, commission):

"""執行賣出"""

if 'BTC' in self.positions:

quantity = self.positions['BTC']

revenue = quantity * price * (1 - commission)

self.current_capital += revenue

del self.positions['BTC']

self.trades.append({

'timestamp': timestamp,

'type': 'sell',

'quantity': quantity,

'price': price,

'revenue': revenue,

'commission': revenue * commission

})

def _calculate_portfolio_value(self, current_price):

"""計算投資組合價值"""

portfolio_value = self.current_capital

if 'BTC' in self.positions:

portfolio_value += self.positions['BTC'] * current_price

return portfolio_value

def generate_performance_report(self):

"""生成績效報告"""

if not self.equity_curve:

return {}

equity_df = pd.DataFrame(self.equity_curve)

equity_df['returns'] = equity_df['portfolio_value'].pct_change()

# 計算績效指標

total_return = (equity_df['portfolio_value'].iloc[-1] / self.initial_capital) - 1

annual_return = (1 + total_return) ** (365 / len(equity_df)) - 1

volatility = equity_df['returns'].std() * np.sqrt(365)

sharpe_ratio = annual_return / volatility if volatility > 0 else 0

# 最大回撤

equity_df['peak'] = equity_df['portfolio_value'].expanding().max()

equity_df['drawdown'] = (equity_df['portfolio_value'] - equity_df['peak']) / equity_df['peak']

max_drawdown = equity_df['drawdown'].min()

# 交易統計

trades_df = pd.DataFrame(self.trades)

if len(trades_df) > 0:

buy_trades = trades_df[trades_df['type'] == 'buy']

sell_trades = trades_df[trades_df['type'] == 'sell']

total_trades = min(len(buy_trades), len(sell_trades))

if total_trades > 0:

# 計算每筆交易的盈虧

trade_pnl = []

for i in range(total_trades):

buy_cost = buy_trades.iloc[i]['cost']

sell_revenue = sell_trades.iloc[i]['revenue']

pnl = sell_revenue - buy_cost

trade_pnl.append(pnl)

win_trades = [pnl for pnl in trade_pnl if pnl > 0]

win_rate = len(win_trades) / len(trade_pnl) if trade_pnl else 0

avg_win = np.mean(win_trades) if win_trades else 0

avg_loss = np.mean([pnl for pnl in trade_pnl if pnl < 0]) if trade_pnl else 0

else:

total_trades = 0

win_rate = 0

avg_win = 0

avg_loss = 0

else:

total_trades = 0

win_rate = 0

avg_win = 0

avg_loss = 0

return {

'total_return': total_return,

'annual_return': annual_return,

'volatility': volatility,

'sharpe_ratio': sharpe_ratio,

'max_drawdown': max_drawdown,

'total_trades': total_trades,

'win_rate': win_rate,

'avg_win': avg_win,

'avg_loss': avg_loss,

'profit_factor': abs(avg_win / avg_loss) if avg_loss != 0 else float('inf')

}

# 執行回測範例

def run_backtest_example():

"""執行回測範例"""

# 創建回測框架

backtest = BacktestFramework(initial_capital=100000)

# 載入歷史數據

data = backtest.load_historical_data('BTC', '2023-01-01', '2024-01-01')

# 計算技術指標

data = backtest.calculate_indicators(data)

# 生成交易信號

data = backtest.generate_signals(data, 'ma_crossover')

# 執行回測

backtest.execute_backtest(data)

# 生成績效報告

performance = backtest.generate_performance_report()

print("回測績效報告:")

print(f"總收益率: {performance['total_return']:.2%}")

print(f"年化收益率: {performance['annual_return']:.2%}")

print(f"年化波動率: {performance['volatility']:.2%}")

print(f"夏普比率: {performance['sharpe_ratio']:.2f}")

print(f"最大回撤: {performance['max_drawdown']:.2%}")

print(f"總交易次數: {performance['total_trades']}")

print(f"勝率: {performance['win_rate']:.2%}")

print(f"盈虧比: {performance['profit_factor']:.2f}")

return backtest, performance

# 執行回測

backtest_result, performance_metrics = run_backtest_example()

class PaperTradingEngine:

"""虛擬交易引擎"""

def __init__(self, initial_balance=100000):

self.balance = initial_balance

self.positions = {}

self.orders = {}

self.trade_history = []

self.is_running = False

async def start_paper_trading(self, strategy, market_data_feed):

"""開始虛擬交易"""

self.is_running = True

print("🚀 虛擬交易系統啟動")

while self.is_running:

try:

# 獲取實時市場數據

market_data = await market_data_feed.get_latest_data()

# 策略生成信號

signals = strategy.generate_signals(market_data)

# 執行虛擬交易

for signal in signals:

await self._execute_paper_order(signal, market_data)

# 更新投資組合

await self._update_portfolio(market_data)

# 記錄狀態

await self._log_status()

# 等待下個週期

await asyncio.sleep(1)

except Exception as e:

print(f"❌ 虛擬交易錯誤: {e}")

await asyncio.sleep(5)

async def _execute_paper_order(self, signal, market_data):

"""執行虛擬訂單"""

symbol = signal['symbol']

side = signal['side']

size = signal['size']

# 獲取當前價格

current_price = market_data[symbol]['price']

# 模擬滑價

slippage = self._calculate_slippage(symbol, size, side)

execution_price = current_price * (1 + slippage)

# 模擬手續費

commission = size * execution_price * 0.001

# 執行交易

if side == 'buy':

required_capital = size * execution_price + commission

if required_capital <= self.balance:

self.balance -= required_capital

self.positions[symbol] = self.positions.get(symbol, 0) + size

trade_record = {

'timestamp': datetime.now(),

'symbol': symbol,

'side': side,

'size': size,

'price': execution_price,

'commission': commission,

'slippage': slippage,

'status': 'filled'

}

self.trade_history.append(trade_record)

print(f"📈 虛擬買入: {size} {symbol} @ ${execution_price:.2f}")

else:

print(f"❌ 餘額不足,無法買入 {symbol}")

elif side == 'sell':

if symbol in self.positions and self.positions[symbol] >= size:

revenue = size * execution_price - commission

self.balance += revenue

self.positions[symbol] -= size

if self.positions[symbol] == 0:

del self.positions[symbol]

trade_record = {

'timestamp': datetime.now(),

'symbol': symbol,

'side': side,

'size': size,

'price': execution_price,

'commission': commission,

'slippage': slippage,

'status': 'filled'

}

self.trade_history.append(trade_record)

print(f"📉 虛擬賣出: {size} {symbol} @ ${execution_price:.2f}")

else:

print(f"❌ 持倉不足,無法賣出 {symbol}")

def _calculate_slippage(self, symbol, size, side):

"""計算滑價"""

# 簡化的滑價模型

base_slippage = 0.0001 # 0.01% 基礎滑價

size_impact = size * 0.000001 # 根據訂單大小調整

slippage = base_slippage + size_impact

# 買入時滑價為正,賣出時為負

return slippage if side == 'buy' else -slippage

async def _update_portfolio(self, market_data):

"""更新投資組合價值"""

total_value = self.balance

for symbol, quantity in self.positions.items():

if symbol in market_data:

current_price = market_data[symbol]['price']

position_value = quantity * current_price

total_value += position_value

return total_value

async def _log_status(self):

"""記錄狀態"""

# 每小時記錄一次詳細狀態

current_time = datetime.now()

if current_time.minute == 0:

portfolio_value = await self._update_portfolio({})

print(f"💰 投資組合價值: ${portfolio_value:.2f}")

print(f"💵 現金餘額: ${self.balance:.2f}")

if self.positions:

print(f"📊 持倉: {self.positions}")

class PaperTradingStrategy:

"""虛擬交易策略範例"""

def __init__(self):

self.last_signals = {}

def generate_signals(self, market_data):

"""生成交易信號"""

signals = []

for symbol, data in market_data.items():

# 簡單的動量策略

current_price = data['price']

# 假設有歷史價格資料

if 'price_history' in data:

price_history = data['price_history']

if len(price_history) >= 20:

sma_20 = sum(price_history[-20:]) / 20

# 價格突破20日均線

if current_price > sma_20 * 1.02: # 突破2%

signals.append({

'symbol': symbol,

'side': 'buy',

'size': 0.1,

'strategy': 'momentum_breakout'

})

elif current_price < sma_20 * 0.98: # 跌破2%

signals.append({

'symbol': symbol,

'side': 'sell',

'size': 0.1,

'strategy': 'momentum_breakdown'

})

return signals

# 虛擬交易範例

async def run_paper_trading_example():

"""運行虛擬交易範例"""

# 創建虛擬交易引擎

paper_engine = PaperTradingEngine(initial_balance=100000)

# 創建策略

strategy = PaperTradingStrategy()

# 模擬市場數據源

class MockMarketDataFeed:

async def get_latest_data(self):

# 模擬實時數據

return {

'BTCUSDT': {

'price': 50000 + np.random.normal(0, 500),

'volume': 1000,

'price_history': [49000 + i * 10 for i in range(25)]

}

}

market_feed = MockMarketDataFeed()

# 運行虛擬交易(這裡只運行幾個週期作為演示)

print("開始虛擬交易演示...")

for i in range(5):

market_data = await market_feed.get_latest_data()

signals = strategy.generate_signals(market_data)

for signal in signals:

await paper_engine._execute_paper_order(signal, market_data)

portfolio_value = await paper_engine._update_portfolio(market_data)

print(f"週期 {i+1}: 投資組合價值 ${portfolio_value:.2f}")

await asyncio.sleep(0.1) # 模擬時間間隔

# 如果在異步環境中運行

# await run_paper_trading_example()

class PaperVsLiveTradingAnalyzer:

"""虛擬交易與實盤交易差異分析"""

def __init__(self):

self.differences = {

'execution': {

'slippage': {

'paper': '模擬滑價,可能過於樂觀',

'live': '真實滑價,特別是大單或低流動性時'

},

'fill_rate': {

'paper': '100%成交,無部分成交',

'live': '可能部分成交或完全不成交'

},

'latency': {

'paper': '無網路延遲',

'live': '網路延遲影響執行價格'

}

},

'psychological': {

'pressure': {

'paper': '無真實資金壓力',

'live': '真實資金的心理壓力'

},

'discipline': {

'paper': '容易遵守規則',

'live': '情緒影響決策執行'

},

'risk_tolerance': {

'paper': '風險承受度較高',

'live': '真實損失時風險厭惡增加'

}

},

'market_impact': {

'order_book': {

'paper': '不影響市場',

'live': '大單可能影響價格'

},

'timing': {

'paper': '完美時機執行',

'live': '交易所維護、網路問題等'

}

}

}

def generate_transition_plan(self):

"""生成從虛擬到實盤的過渡計劃"""

plan = {

'phase_1': {

'duration': '2-4週',

'goal': '驗證策略邏輯',

'actions': [

'在虛擬環境中運行策略',

'記錄所有交易決策',

'分析策略表現',

'優化參數設定'

],

'success_criteria': [

'正收益率',

'合理的夏普比率',

'可控的最大回撤'

]

},

'phase_2': {

'duration': '1-2週',

'goal': '小額實盤驗證',

'actions': [

'使用最小金額實盤交易',

'比較虛擬與實盤結果',

'記錄心理變化',

'調整執行參數'

],

'success_criteria': [

'實盤表現接近虛擬交易',

'能夠控制情緒',

'嚴格執行策略'

]

},

'phase_3': {

'duration': '4-8週',

'goal': '逐步增加資金',

'actions': [

'每週評估表現',

'逐步增加交易規模',

'持續優化策略',

'建立風控機制'

],

'success_criteria': [

'穩定的正收益',

'控制回撤在可接受範圍',

'建立交易信心'

]

},

'phase_4': {

'duration': '持續',

'goal': '正式運營',

'actions': [

'使用目標資金規模',

'持續監控和優化',

'定期回顧和調整',

'風險管理機制完善'

],

'success_criteria': [

'達到預期收益目標',

'風險控制有效',

'策略持續有效'

]

}

}

return plan

analyzer = PaperVsLiveTradingAnalyzer()

transition_plan = analyzer.generate_transition_plan()

print("從虛擬交易到實盤交易的過渡計劃:")

for phase, details in transition_plan.items():

print(f"\n{phase.upper()}:")

print(f" 期間: {details['duration']}")

print(f" 目標: {details['goal']}")

print(f" 行動:")

for action in details['actions']:

print(f" • {action}")

print(f" 成功標準:")

for criteria in details['success_criteria']:

print(f" ✓ {criteria}")

class GoLiveChecklist:

"""上線檢查清單"""

def __init__(self):

self.checklist = {

'strategy_validation': [

'回測結果滿意(正收益、合理回撤)',

'虛擬交易表現良好(至少4週)',

'小額實盤測試成功',

'策略邏輯經過同行評議',

'參數設定經過優化'

],

'technical_infrastructure': [

'交易系統穩定運行',

'API連接穩定可靠',

'備用系統準備就緒',

'監控系統完善',

'日誌記錄完整'

],

'risk_management': [

'風險控制參數設定',

'止損機制完善',

'最大回撤限制',

'倉位大小控制',

'緊急停止機制'

],

'operational_readiness': [

'交易資金準備充足',

'團隊角色分工明確',

'應急預案制定完成',

'監控值班安排',

'定期評估機制'

],

'compliance_legal': [

'合規要求確認',

'稅務處理準備',

'監管報告機制',

'資金來源合法',

'風險披露完整'

]

}

def evaluate_readiness(self, completed_items):

"""評估上線準備度"""

total_items = sum(len(items) for items in self.checklist.values())

completed_count = len(completed_items)

readiness_score = completed_count / total_items

if readiness_score >= 0.9:

recommendation = "準備就緒,可以上線"

risk_level = "低"

elif readiness_score >= 0.8:

recommendation = "基本準備就緒,建議補充剩餘項目"

risk_level = "中低"

elif readiness_score >= 0.7:

recommendation = "需要完成更多準備工作"

risk_level = "中"

else:

recommendation = "準備不足,不建議上線"

risk_level = "高"

return {

'readiness_score': readiness_score,

'recommendation': recommendation,

'risk_level': risk_level,

'completed_items': completed_count,

'total_items': total_items

}

# 使用檢查清單

checklist = GoLiveChecklist()

# 模擬已完成的項目

completed_items = [

'回測結果滿意(正收益、合理回撤)',

'虛擬交易表現良好(至少4週)',

'交易系統穩定運行',

'API連接穩定可靠',

'風險控制參數設定',

'止損機制完善',

'交易資金準備充足'

]

evaluation = checklist.evaluate_readiness(completed_items)

print(f"上線準備度評估:")

print(f"完成度: {evaluation['readiness_score']:.1%}")

print(f"建議: {evaluation['recommendation']}")

print(f"風險等級: {evaluation['risk_level']}")

class LiveTradingMonitor:

"""實盤交易監控系統"""

def __init__(self, telegram_notifier=None):

self.telegram_notifier = telegram_notifier

self.alerts = []

self.performance_metrics = {}

async def monitor_trading_performance(self, trading_engine):

"""監控交易表現"""

while True:

try:

# 獲取當前表現

current_metrics = await self._calculate_metrics(trading_engine)

# 檢查異常情況

alerts = self._check_alerts(current_metrics)

# 發送警告

for alert in alerts:

await self._send_alert(alert)

# 記錄表現

self.performance_metrics = current_metrics

# 等待下次檢查

await asyncio.sleep(300) # 5分鐘檢查一次

except Exception as e:

await self._send_alert({

'type': 'system_error',

'message': f'監控系統錯誤: {e}',

'severity': 'high'

})

await asyncio.sleep(60)

async def _calculate_metrics(self, trading_engine):

"""計算關鍵指標"""

portfolio_value = await trading_engine.get_portfolio_value()

daily_pnl = await trading_engine.get_daily_pnl()

open_positions = await trading_engine.get_open_positions()

return {

'portfolio_value': portfolio_value,

'daily_pnl': daily_pnl,

'open_positions_count': len(open_positions),

'total_exposure': sum(pos['value'] for pos in open_positions),

'timestamp': datetime.now()

}

def _check_alerts(self, metrics):

"""檢查警告條件"""

alerts = []

# 檢查日損失

if metrics['daily_pnl'] < -5000: # 日損失超過5000

alerts.append({

'type': 'high_daily_loss',

'message': f'日損失過大: ${metrics["daily_pnl"]:.2f}',

'severity': 'high'

})

# 檢查持倉集中度

if metrics['open_positions_count'] > 10:

alerts.append({

'type': 'high_position_count',

'message': f'持倉數量過多: {metrics["open_positions_count"]}',

'severity': 'medium'

})

# 檢查總敞口

max_exposure = 50000 # 最大敞口5萬

if metrics['total_exposure'] > max_exposure:

alerts.append({

'type': 'high_exposure',

'message': f'總敞口過大: ${metrics["total_exposure"]:.2f}',

'severity': 'high'

})

return alerts

async def _send_alert(self, alert):

"""發送警告"""

self.alerts.append(alert)

if self.telegram_notifier:

message = f"🚨 {alert['severity'].upper()} ALERT\n"

message += f"類型: {alert['type']}\n"

message += f"訊息: {alert['message']}\n"

message += f"時間: {datetime.now().strftime('%Y-%m-%d %H:%M:%S')}"

await self.telegram_notifier.send_message(message)

print(f"⚠️ ALERT: {alert['message']}")

# 上線監控範例

async def setup_live_monitoring():

"""設置實盤監控"""

monitor = LiveTradingMonitor()

# 假設有交易引擎

class MockTradingEngine:

async def get_portfolio_value(self):

return 98500 # 模擬投資組合價值

async def get_daily_pnl(self):

return -1500 # 模擬日損益

async def get_open_positions(self):

return [

{'symbol': 'BTCUSDT', 'value': 10000},

{'symbol': 'ETHUSDT', 'value': 5000}

]

trading_engine = MockTradingEngine()

# 運行監控(演示版本)

metrics = await monitor._calculate_metrics(trading_engine)

alerts = monitor._check_alerts(metrics)

print("監控指標:")

for key, value in metrics.items():

if key != 'timestamp':

print(f" {key}: {value}")

if alerts:

print("\n發現警告:")

for alert in alerts:

print(f" {alert['severity']}: {alert['message']}")

else:

print("\n✅ 系統狀態正常")

# 運行監控演示

# await setup_live_monitoring()

今天我們學習了量化交易從想法到實現的完整流程,就像農夫從試驗田到大規模種植的過程。重要概念包括:

回測階段:

虛擬交易階段:

正式上線階段:

關鍵成功因素:

記住爸爸說過的話:「種田要先在小塊地試驗,成功了再擴大規模」。量化交易也是如此,每個階段都有其重要作用,不可跳躍!

明天我們將深入學習期現套利策略的具體實作,這是量化交易中相對穩健的策略之一。

下一篇:Day 23 - 範例期現套利策略